- Published on

The Financial Calculus of Wrongful Denials

- Authors

- Name

- Mike Gartner, PhD

Health insurance coverage denials jeopardize people’s physical, mental, and financial well being. Research focused on inappropriate denials - those which are inconsistent with law, contracts, or consensus medical opinion - is relatively uncommon. While denial rate analyses abound, the extent to which systematic administration of inappropriate denials is borne out by the same data is less studied.

We investigate the financial calculus governing broad, intentional administration of inappropriate denials1. We focus in particular on the critical role appeals play in this calculus.

The goal of this article is to use data to provide partial evidence for the following story:

Appeals are currently palatable for insurers.

Administering large volumes of inappropriate denials is financially viable, under current conditions. For many types of health insurance, the primary downside to inappropriate denials is the potential for appeal costs and losses. While appeals are undesirable for insurers and lower profits, they are palatable at current levels.

The viability of current denial patterns depends on low appeal rates.

Appeal rates are low across most types of health insurance. Major insurance companies monitor these rates, and understand them well. The number of appeals and overturns are important terms in their profit equations. Appeals and overturns lessen the profit incentive to administer denials, and inform targeted, strategic denial patterns.

Scaling appeals is a non-legislative pathway to systemic change.

High appeal rates would alter the calculus insurers use to inform adjudication practices. With enough appeals and overturns, it would cost more to administer inappropriate denials than to cover the associated services. While the exact systemic change that would result is impossible to predict, it is safe to assume that insurers will not act against their own financial interests.

An Example: Commercial Health Insurance in New York

For the sake of concreteness, let's focus on a particular appeal funnel. Let's consider post-service denials from commercial insurers in New York in 2023.

Patients with commercial health insurance in New York have access to internal and external appeals. The insurance companies that administer the initial denials also review the internal appeals. Independent Review Organizations (IROs) serve as third party entities contracted to review external the appeals.

The Appeal Funnel

New York's commercial insurer appeal funnel exhibits qualities typical of such distributions:

There are a large volume of post-service denials, worth tens of billions of dollars.

Patients internally appeal a small fraction (< 1%) of all denials. Yet those appeals get overturned at a relatively high rate (> 20%). Moreover, the small fraction of denials appealed still amount to a disagreement worth billions of dollars.

Patients externally appeal a small fraction (~5%) of upheld internal appeals. Yet those appeals get overturned at a relatively high rate (>40%). This amounts to tens of millions of dollars in disagreements, even using conservative estimates for the average (unknown) value of externally appealed claims.

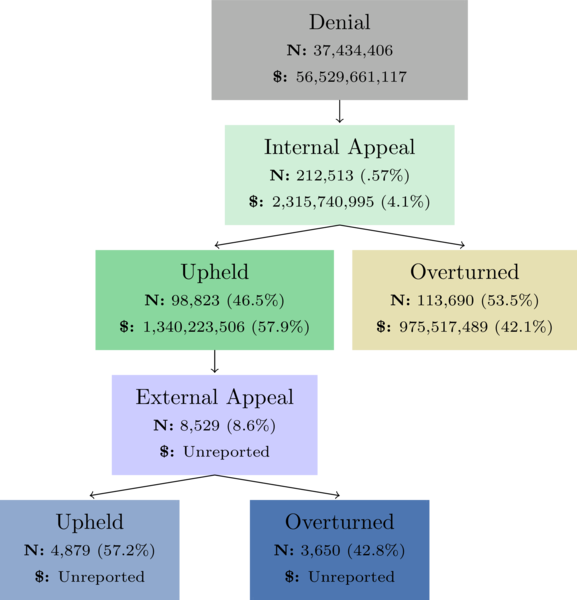

The exact distribution in the appeal funnel is shown in Figure 1.

Figure 1: A typical appeal funnel distribution, from 2023 for New York's commercial insurers that report data via the New York Health Care Claims Reports. For each bucket in the appeal funnel, the total volume of claims is recorded, as is the corresponding billed value. The reported external appeal data does not include billed values. The number of 'Overturned' internal appeals, and the corresponding billed value, represents both fully and partially overturned internal appeals.

The Story

Appeals are Currently Palatable For insurers

Figure 1 shows that the billed value associated with denials is more than $56B. Less than 1 percent of those denials, worth roughly $2B, are appealed.

In general, it is not free for insurers to administer denials that are inappropriate. Those that get appealed incur the overhead of appeals processes. Those that get appealed and overturned result in a net loss. Egregious inappropriate cases run additional risks for major losses from law suits. And in some contexts (though typically not in commercial contexts), regulators track appeal overturn metrics in ways that directly affect insurer profits2.

These risks and costs, however, are completely offset by uncontested denials. Given existing appeal rates, insurers can systematically administer inappropriate denials, lose 100% of appeals, and still come out ahead3. Major insurers want to lower appeal rates and overturn rates, but doing so is not necessary to sustain or increase profits. Nor is eradicating inappropriate denials. This is a fundamental accountability flaw in the design of existing regulation.

The Viability of Current Denial Patterns Depends on Low Appeal Rates

The cost to insurers of inappropriate denials need not be less than the gains. The net revenue outcome is a function of many variables, one of which is the internal appeal rate. The actual 2023 internal appeal rate among commercial insurers was .57%. This is low enough to allow for the profitability of intentional inappropriate denials3. However, the calculation becomes unfavorable to insurer profits as appeal rates rise.

Scaling Appeals is a Non-Legislative Pathway to Systemic Change

What would happen if the the internal appeal rate were increased dramatically? First of all, the cost to insurers of appeal administration would increase. Second, the net savings generated from inappropriate denials would decrease for each additional appeal overturn. In the extreme limit, if 100% of inappropriate denials were appealed, and all of them were overturned, the administration of such denials would be a net loss to insurers (amounting to the total value of administration costs, law suit losses, and lower order effects). If this reality were achieved, insurers would be financially incentivized to ensure such denials never occurred. Currently, they have the opposite financial incentive.

Exploring the Impact of Heightened Appeal Rates

To illustrate the potential impact of scaling appeals, let's consider what would happen if more denials from New York's commercial market were appealed, under various assumptions about success rates.

The widget below displays the total billed monetary values and volumes associated with each part of the appeal funnel, based on the actual values reported among commercial insurers in New York in 2023. Alter the values for the phenomenological rates in the sliders below to see what the impact would be on the appeal funnel distribution.

Appeal Utilization Projector

Additional Overturns

0

Additional Overturned Value

$0

| Funnel Stage | Total Volume | Total Billed Value |

|---|---|---|

| Denials | 37,434,406 | $56,529,661,118 |

| Internal Appeals | 212,513 | $2,315,740,996 |

| Upheld Internal Appeals | 98,823 | $1,340,223,506 |

| Overturned Internal Appeals | 113,690 | $975,517,489 |

| External Appeals | 8,529 | $115,669,088 |

| Upheld External Appeals | 4,879 | $66,168,306 |

| Overturned External Appeals | 3,650 | $49,500,782 |

Note that even modest increases in appeal utilization and success have high value implications. For example, increasing currently observed internal appeal rates from .57% to 3% of all denied claims while holding all other phenomenology the same, would result in approximately 228,238 extra overturned claims and $332,429,762 returned to patients4.

These numbers are particularly astounding given the staggering and dire implications of medical debt in America, and the fraught nature of inappropriate prior authorization denials for those seeking care critical to their health.

One takeaway is that patients should be appealing inappropriate denials whenever possible. We need organizations, regulators, and individuals to support patients in scaling the rate at which they appeal. The recouped monetary value alone is significant, and there are many important additional implications for the well being of patients, and perverse financial incentives in our health system.

Conclusion

It is in the best interest of patients, as individuals, to appeal inappropriate denials more frequently. Many organizations (including Persius) have long helped promote that message, and support patients in seeking appeal recourse, to the benefit of patients.

What's less understood and less often said is that it is in the best interests of society, as a collection of patients, to drive increased appeal utilization. Driving appeal rates higher on a societal scale stands to directly disincentivize inappropriate denials financially. This is presumably well understood by some regulators, as there are already smart and effective, though limited, mechanisms implemented in some markets to help financially incentivize appropriate adjudication5. Increased appeal utilization would have implications for our healthcare systems at large, in addition to improving outcomes for individuals.

Contact

If you find our work useful, or are interested in getting involved, we'd love to hear from you. Please feel free to reach out with questions, comments, or feedback to info@persius.org, and sign up for our newsletter below if you'd like to stay up to date with our work.

Footnotes

To be clear, we study the viability of broad and intentional administration of inappropriate denials, whether or not such broad and intentional administration occurs. The data we share does not conclusively demonstrate the inappropriate nature of denials, nor any intent. ↩

For example, see measure C29 of the 2024 Medicare Star Rating system. ↩

For example, suppose NY commercial insurers administered $10B of the $56B via intentional inappropriate denials, and that all $2B in appeals were for such denials. The data shows such systematic bad faith behavior would be financially beneficial, even with 100% appeal overturn rate, so long as the losses from appeal administration, law suits, and lower order effects totaled less than $8B. For example, $10B in intentional inappropriate denials could result in $2B in overturns, and $5B in other losses, with a net payment responsibility of $7B for insurers (a $3B savings compared to the $10B they would have been responsible for had they initially covered these services). ↩ ↩2

The monetary projection requires an assumption about how the average value of overturned claims would change as a function of appeal rate. We chose such a function which we believe is reasonable, but which cannot definitively be guaranteed to reflect what would occur in reality. Nonetheless, the estimated projections give a ballpark for the amount of money that would be recouped. ↩

For example, in Medicare Advantage Measure C29 of the 2024 Medicare Star Rating system, coupled with automatic forwarding of upheld level 1 appeals is such a mechanism. ↩